The video (embedded below) is for those Accounting firms who split part, or all, of the Year End Accounts work from the related Corporate tax work – typically by allocating tax compliance to different team members, teams or departments. The question is – how can Glide help your process to remain joined up and client friendly? How can you keep the turnaround time down?

It’s a UK example but the same concept can be applied in any country.

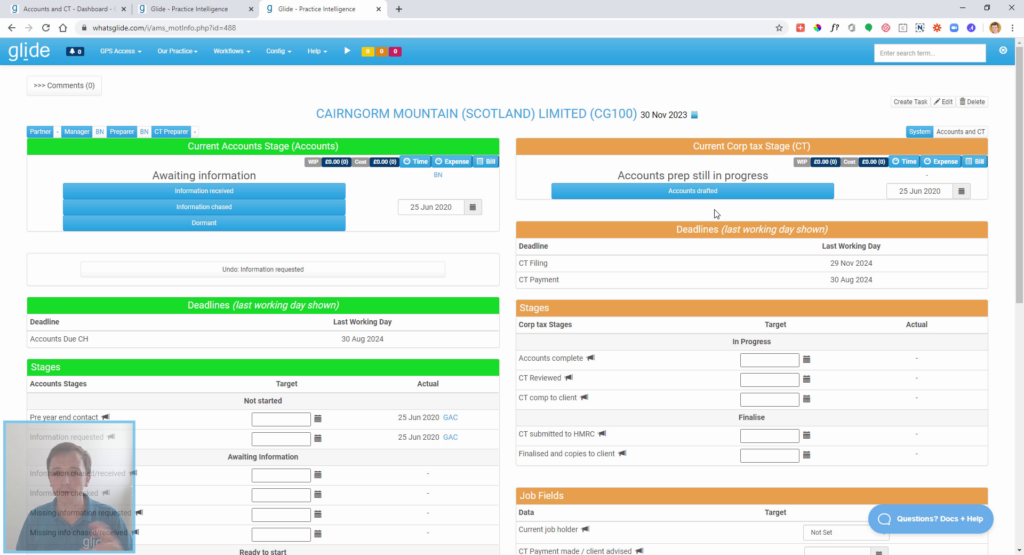

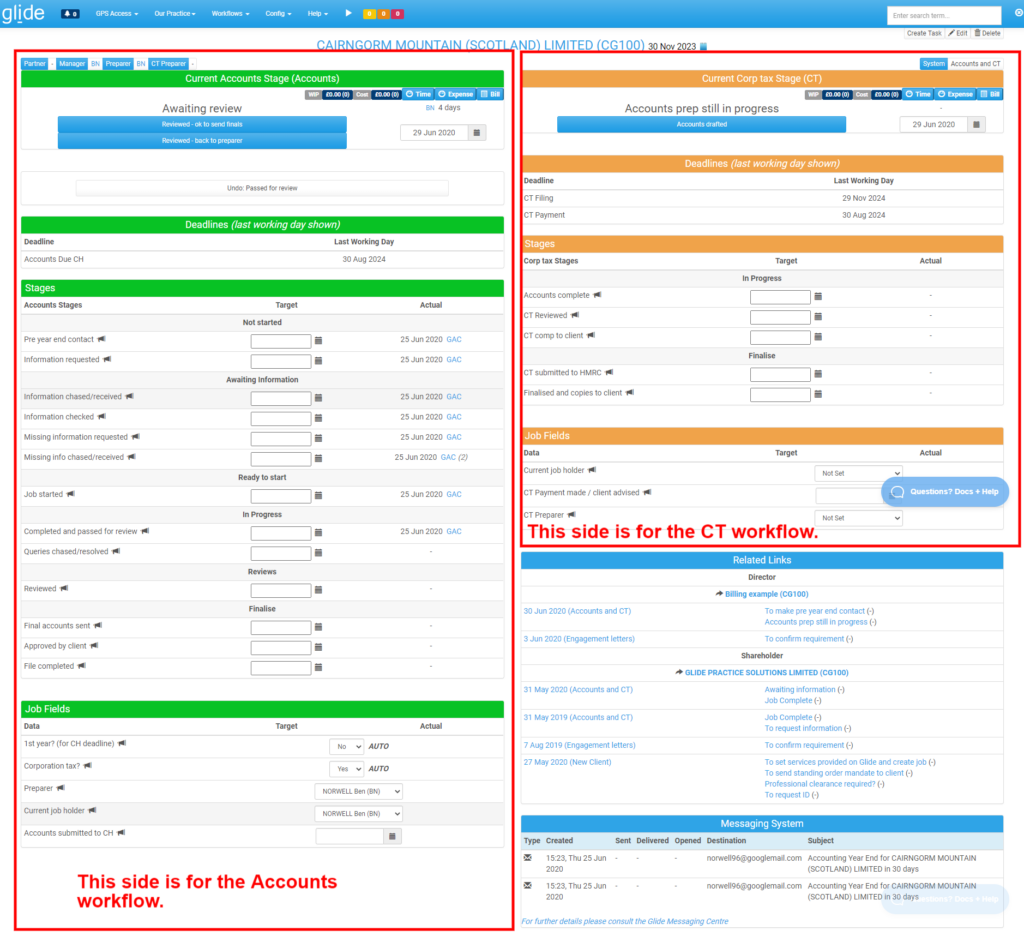

The answer is that we recommend you create one workflow system but then split that into two sub-systems. Have a look at the job card screen grab below – where you would typically see one of everything (think current stage, progress buttons, target dates, actual dates, job fields etc) – you instead see two.

We are effectively progressing two totally separate jobs on a single job card. You can actually have an unlimited number of sub-systems in each of your workflow systems, the vast majority of workflows only need one but our New Client Onboarding template currently has 4!

You can do this whenever processes share both a job date and frequency – in our case the Accounts and CT are both orientated around the Year End and are both annual.

So what are the main benefits of this approach. Well firstly you get all the benefits you would have if you were to have two entirely separate workflow systems, such as:

- CT has its own process with all the obvious advantages this conveys such as knowing accurately what stage each job is at, the ability to map out a dedicated CT process, a record of all target and actual dates etc etc etc.

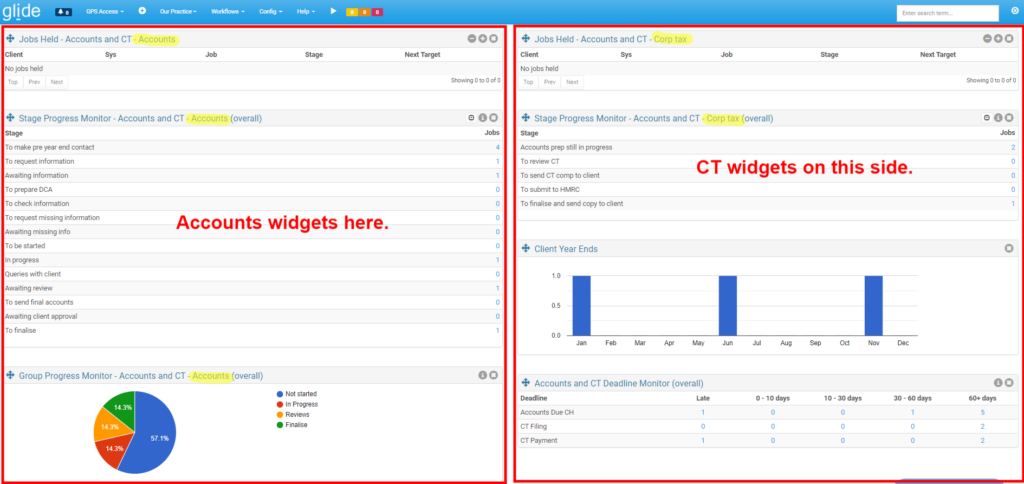

- You’ll get dedicated dashboard widgets for each sub-system. I’ve added a screen grab below showing how, in this example, I can have a progress monitor for Accounts and separately for CT.

- CT will have its own job holder – so while the Accounts might be held by various members of the Accounts team – the CT could be routed around the tax department.

- CT will have its own alerts – so you could alert a tax preparer if the job has not been started within 10 working days of becoming available (as an example).

The main benefits; however, stem from the fact that each part of the job is aware of the other – this would not be the case with two totally unconnected workflow systems. These benefits include:

- One part of the job can block the other. For example you can block the ability to send out the Accounts until there has been a CT review.

- One part of the job can auto progress the other. For example you might auto progress your CT to ‘Ready to review’ once the draft Accounts have been produced.

- One part of the job can set target dates on the other and these target dates can be calculated relative to dates on either part of the job. For example you might set a target to complete the CT +30 working days after the Accounts have been signed.

- Message templates can merge information form both parts of the job. For example you might automate an e-mail to your clients which references both your Accounts and CT statutory deadlines.

The advantages listed in this blog relate to quite specific capabilities of the Gide software. Of course the most important benefit for your firm may simply be that team members from both teams gain perfect visibility over the job progress of the other via a shared platform!